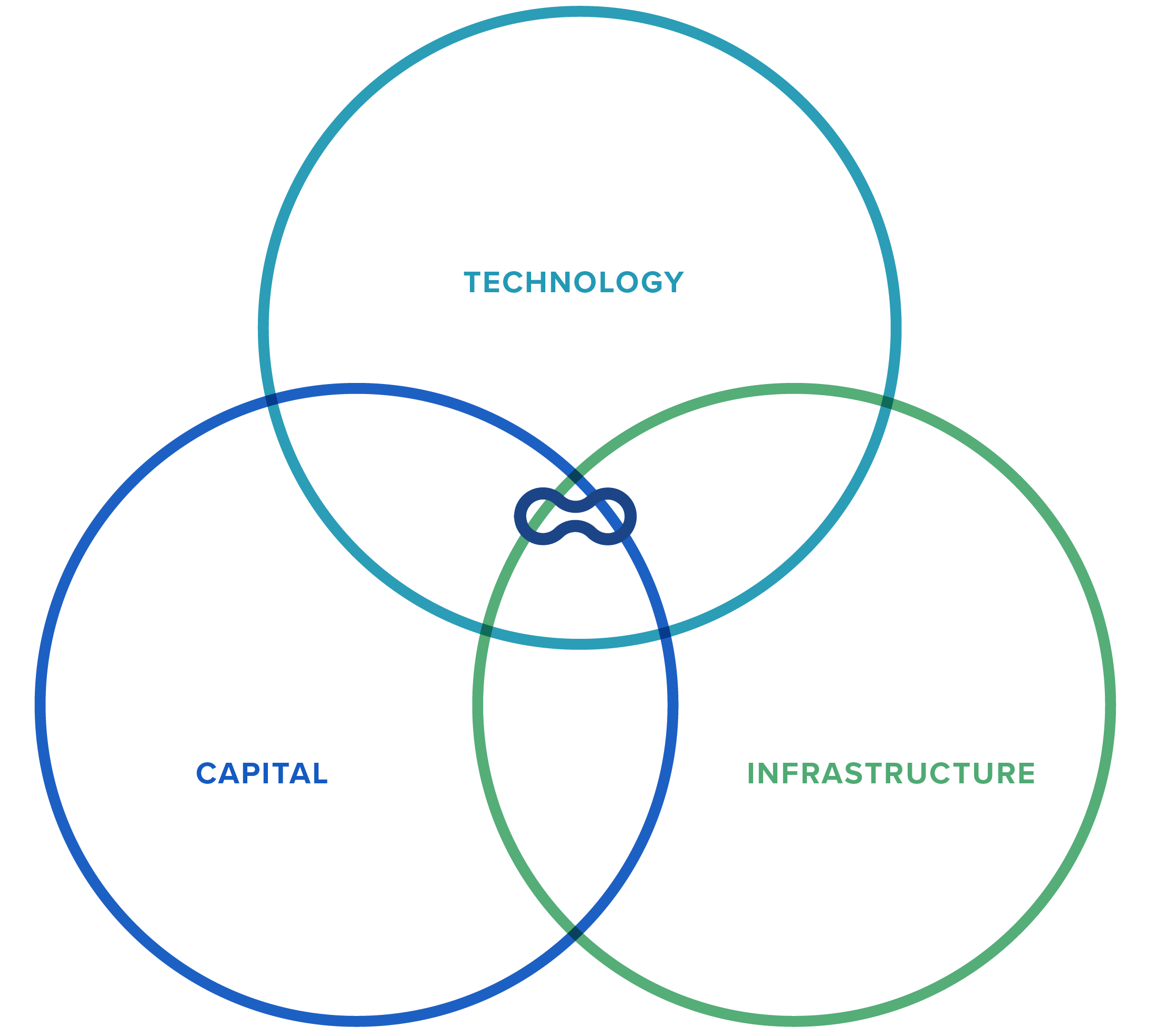

We manage the three core assets of the energy transition

Capella is not a typical asset manager. We manage capital assets, but also the technology and infrastructure assets that we purchase. This integrated approach to asset management is essential to successfully navigating the energy transition.

Our approach is simple. We deploy our partners’ capital into carefully-selected technology and infrastructure assets that directly address each partner’s unique financial and strategic objectives. We then manage and accelerate those positions until the objectives are realized, and we participate in the resulting upside.

Capital

Capital must be managed with great care, particularly as investors move from the mature landscape of oil & gas assets to the burgeoning world of clean energy. There are an abundance of clean energy opportunities in a market that’s moving ever-faster, with valuations often based on demand rather than fundamentals. As a result, investors can struggle to separate what’s real from what isn’t. As seasoned venture capitalists, we are no strangers to such market dynamics. We navigate these waters with a tested and consistent process: making decisions from fundamental analysis and first-principles.

Technologies

Technologies are the toolset for the energy transition, and the form factor of technology assets is intellectual property. Our in-house IP experts have built, commercialized, and asserted two of the most powerful patent portfolios in existence (Sonos and TAE), creating tens of billions of dollars of direct value. We manage technology assets that deliver viable solutions for the energy transition and strong techno-economic fundamentals, and we manage the corresponding IP to protect shareholder value.

Infrastructure

Infrastructure is where the rubber meets the road. Realizing the energy transition requires that clean energy solutions compete successfully at scale against their hydrocarbon equivalents. Our central KPI for benchmarking clean energy solutions against each other and their hydrocarbon equivalents is Levelized Cost (“LCOx”), where x is the commodity we are providing, such as electricity, hydrogen, storage, or heat. Our techno-economic analysis of infrastructure mega-projects and the technologies with which they are constructed is served by subject matter experts with broad exposure to best-practices and market alternatives.

“We cannot solve our problems with the same thinking we used when we created them.”